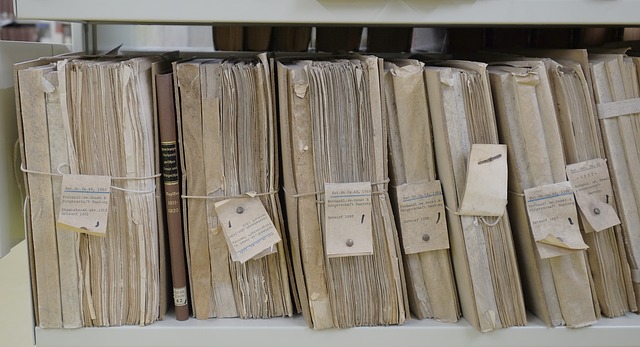

Keep These Documents for Good Record Keeping

Have you ever wondered how long you should keep financial documents? Well, it's a common question that CPA's hear from clients. Considering how common the question is, the accounting team at C.E. Thorn, CPA, PLLC have put together a list of forms and documents that you should keep in case you are audited by the IRS.

3 Year Rule for Tax Documents

3 Year Rule for Tax Documents

The IRS has a rule of 3 years in which they can initiate an audit. This helps reduce the paperwork that individuals and small business owners must keep on file. Most of the documents you can discard are supporting tax documents, because your actual tax returns should be kept on file permanently.

Tax Documents to Keep at Least 3 Years

Keep forms that report income wages, interest, dividends, capital gains or losses.

- w-2 Forms

- Forms 1099

Keep records that show you have health insurance or that show criteria for exemption.

- Forms 1095

Receipts for Charitable Contributions, Retirement Accounts and other Savings Plans.

Expense Records

- Deductions and Credits on Income Tax Return

- Withdrawals from Health Savings Accounts

- Schedule C Business Deductions

- Bills of Sale for Assets used for a Business

Saving Records Beyond 3 Years

Records Showing Taxable Gain or Loss

- Property or Investments

Purchase Records

- Mutual Funds

- Stocks

- Investments

Inherited Stocks

- Keep track of the value of the stock when inherited

Reinvested Dividends

- Keep records showing previous tax payments to avoid double taxation when selling stock

A Good Rule of Thumb

Even though the IRS usually only audits returns from the last 3 years, it is a good idea to keep records for at least 6 years since there are some circumstances in which they can go back more than 3 years.

Contact a Professional for Support

As you can see, there are many areas that will need to be accounted for if you are audited by the IRS. It is best to work with a skilled and experienced accounting professional to avoid problems during your audit. Most of the time, working with a local CPA can help prevent an audit in the first place. Contact the Raleigh small business accountants of C.E. Thorn, CPA, PLLC to find out what records you will need to keep and which are ok to purge.

Call 919-420-0092 or complete the online contact form to work with a professional CPA in Raleigh and you can be in better position to prevent trouble with the IRS.

Contact Form

Feel free to call our office or to complete the contact form below:

"*" indicates required fields